USDA loan refinance: Restructure Your Mortgage to Fit Your Current Budget.

USDA loan refinance: Restructure Your Mortgage to Fit Your Current Budget.

Blog Article

Accomplish Reduced Repayments: Crucial Insights on Lending Refinance Options

Loan refinancing offers a critical chance for property owners looking for to reduce their monthly settlements and overall financial obligations. By taking a look at various re-finance alternatives, such as rate-and-term and cash-out refinancing, individuals can customize remedies that line up with their specific monetary situations. The choice to refinance entails cautious consideration of market problems, personal finances, and lending institution contrasts to genuinely take advantage of on potential advantages. As we discover these elements, one might question: what crucial elements could either enhance or weaken the refinancing process?

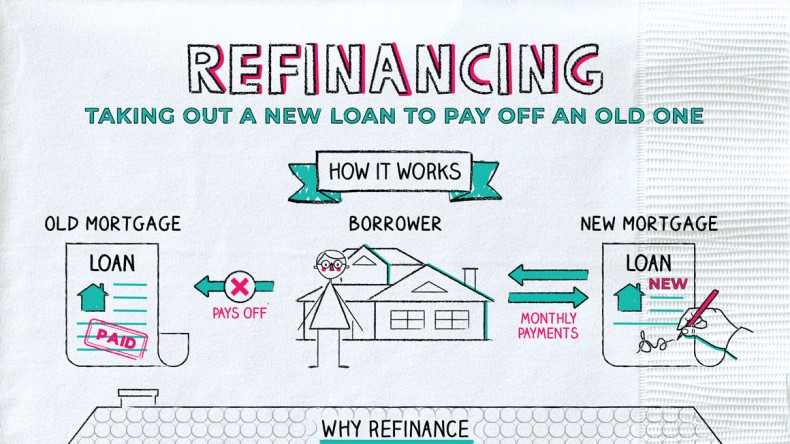

Understanding Loan Refinancing

Funding refinancing is a monetary technique that permits customers to change their existing finances with brand-new ones, generally to safeguard a lot more beneficial terms. This process can lead to lower rates of interest, reduced regular monthly settlements, or a various funding duration that much better aligns with the debtor's financial goals.

The main motivation behind refinancing is to improve financial adaptability. By assessing existing market problems, borrowers might discover that interest rates have decreased considering that their original lending was secured, which might result in substantial financial savings in time. In addition, refinancing can supply chances to settle financial debt, changing numerous high-interest commitments right into a single manageable payment.

It is important to think about the linked costs of refinancing, such as closing costs and various other expenditures, which can offset possible savings. Reviewing one's financial circumstance and long-lasting purposes is important before devoting to refinancing.

Sorts Of Refinance Options

Re-financing deals several options customized to satisfy diverse economic requirements and goals. One of the most usual kinds include rate-and-term refinancing, cash-out refinancing, and improve refinancing.

Rate-and-term refinancing enables debtors to readjust the rate of interest, finance term, or both, which can bring about reduce monthly repayments or minimized total interest costs. This option is usually pursued when market rates drop, making it an enticing option for those looking to reduce rate of interest.

Cash-out refinancing allows home owners to access the equity in their property by borrowing greater than the existing mortgage balance. The difference is taken as money, giving funds for significant expenses such as home restorations or debt combination. This alternative raises the general lending quantity and may impact long-lasting monetary stability.

Each of these refinancing kinds supplies distinct advantages and factors to consider, making it important for customers to evaluate their particular financial situations and goals before continuing.

Benefits of Refinancing

Refinancing can provide a number of financial advantages, making it an attractive option for several. If market rates have actually reduced because the original home mortgage was safeguarded, homeowners might re-finance to acquire a anchor reduced rate, which can lead to lowered monthly payments and significant savings over the loan's term.

In addition, refinancing can assist home owners gain access to equity in their home. By selecting a cash-out re-finance, they can transform a portion of their home equity right into money, which can be made use of for home enhancements, financial obligation loan consolidation, or various other monetary needs.

An additional benefit is the possibility to transform the lending terms. Homeowners can change from an adjustable-rate home mortgage (ARM) to a fixed-rate home loan for better stability, or shorten the financing term to settle the home loan quicker and conserve on interest costs.

Variables to Take Into Consideration

Before determining to refinance a home loan, house owners need to carefully review several vital factors that can dramatically affect their monetary circumstance. First, the present rates see this of interest out there need to be evaluated; refinancing is typically helpful when rates are reduced than the existing home mortgage rate. Additionally, it is necessary to consider the remaining regard to the existing home loan, as expanding the term might bring about paying more rate of interest over time, in spite of lower regular monthly payments.

Last but not least, house Continued owners ought to analyze their long-lasting economic objectives. If preparing to relocate the future, refinancing may not be the most effective choice (USDA loan refinance). By thoroughly thinking about these factors, homeowners can make informed choices that align with their financial goals and total security

Steps to Refinance Your Loan

As soon as property owners have actually examined the crucial aspects influencing their decision to re-finance, they can wage the needed actions to complete the procedure. The primary step is to figure out the kind of re-finance that finest fits their economic objectives, whether it be a rate-and-term refinance or a cash-out refinance.

Next, homeowners ought to gather all appropriate monetary records, consisting of income statements, tax obligation returns, and info about existing financial debts. This paperwork will certainly be crucial when using for a brand-new finance.

Once an appropriate lender is picked, homeowners can submit their application. The loan provider will perform a complete evaluation, which may consist of an assessment of the residential or commercial property.

After authorization, homeowners will certainly get a Closing Disclosure describing the regards to the brand-new car loan. Upon closing, the brand-new finance will certainly pay off the existing home loan, and homeowners can start delighting in the advantages of their refinanced lending, consisting of lower month-to-month settlements or access to money.

Final Thought

In verdict, funding refinancing offers a beneficial possibility for house owners to accomplish reduced payments and reduce financial stress - USDA loan refinance. By understanding different re-finance alternatives, such as rate-and-term, cash-out, and streamline refinancing, people can make informed choices customized to their economic scenarios.

Report this page